Source The Hindu

Former US President Donald Trump has named Kevin Warsh, a former Federal Reserve Governor, as the next Chair of the Federal Reserve, replacing incumbent Jerome Powell. The announcement marks a significant shift in the leadership of the US central bank at a time when economic policy, inflation control, and interest rate decisions remain under intense political and market scrutiny.

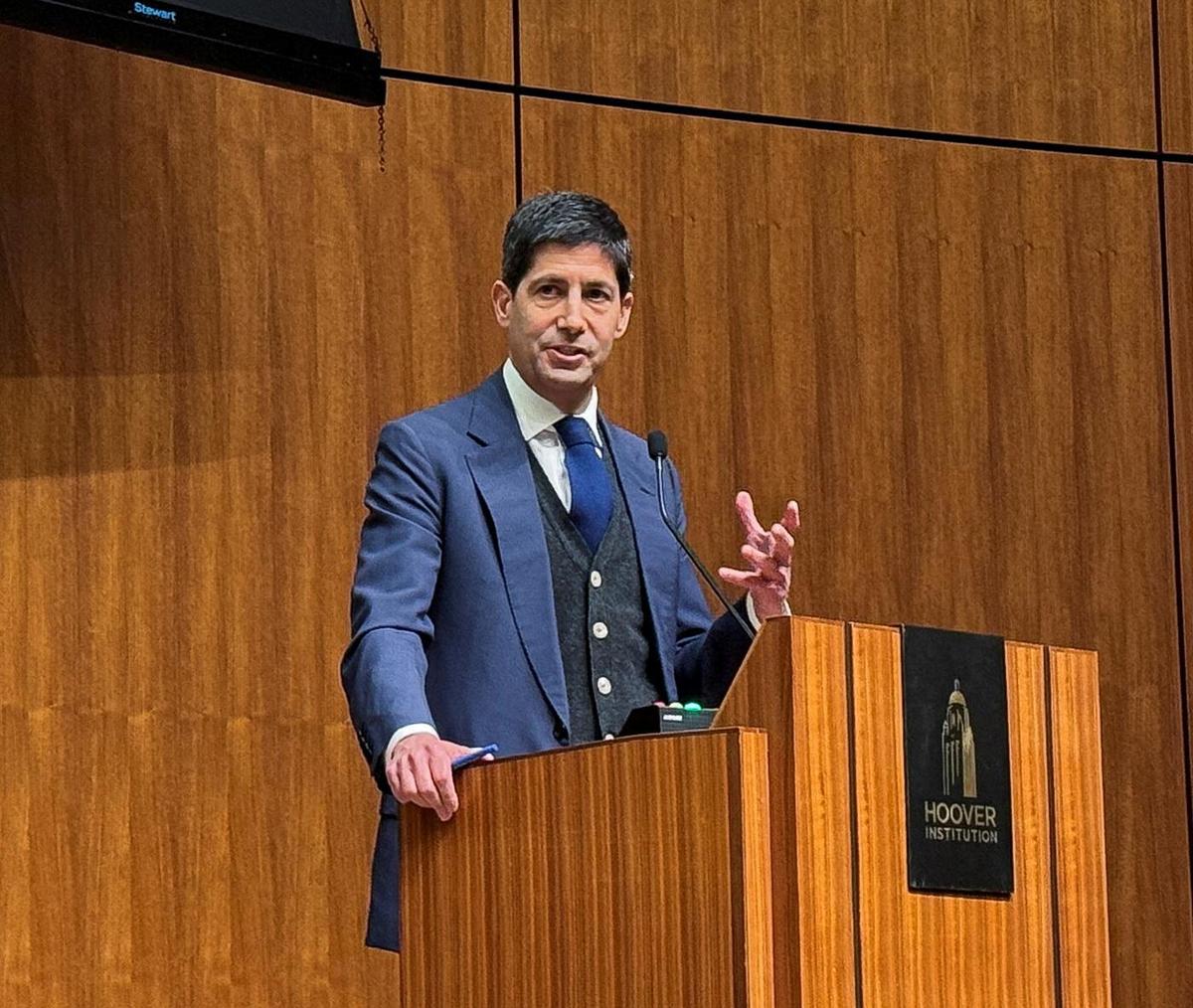

Warsh, who served as a Federal Reserve Governor from 2006 to 2011, is known for his close involvement in policymaking during the global financial crisis. During his tenure, he worked closely with then-Fed Chair Ben Bernanke and played a key role in shaping the central bank’s response to the 2008 economic meltdown. A former investment banker and economic adviser, Warsh has often been viewed as a strong advocate of monetary discipline and market-driven policies.

Trump, announcing the decision, praised Warsh’s experience and understanding of the US economy, saying the former Fed Governor would bring “clarity, strength, and accountability” to the central bank. Trump has long been critical of Jerome Powell’s handling of interest rates, frequently accusing the Fed under Powell of policies that, in his view, slowed economic growth.

Jerome Powell, who has served as Fed Chair since 2018, oversaw the central bank through unprecedented challenges, including the COVID-19 pandemic, supply chain disruptions, and the recent fight against high inflation. His tenure has been marked by aggressive interest rate hikes aimed at curbing inflation, moves that drew both praise and criticism from political leaders and economists alike.

Warsh’s appointment is expected to reignite debate over the independence of the Federal Reserve, especially given Trump’s past public pressure on the institution. Financial markets are likely to closely watch Warsh’s policy signals, particularly his stance on inflation, interest rates, and regulatory oversight.

As Warsh prepares to take the helm, analysts say his leadership could bring a more hawkish tone to US monetary policy, with potential global implications given the Fed’s central role in the world economy.