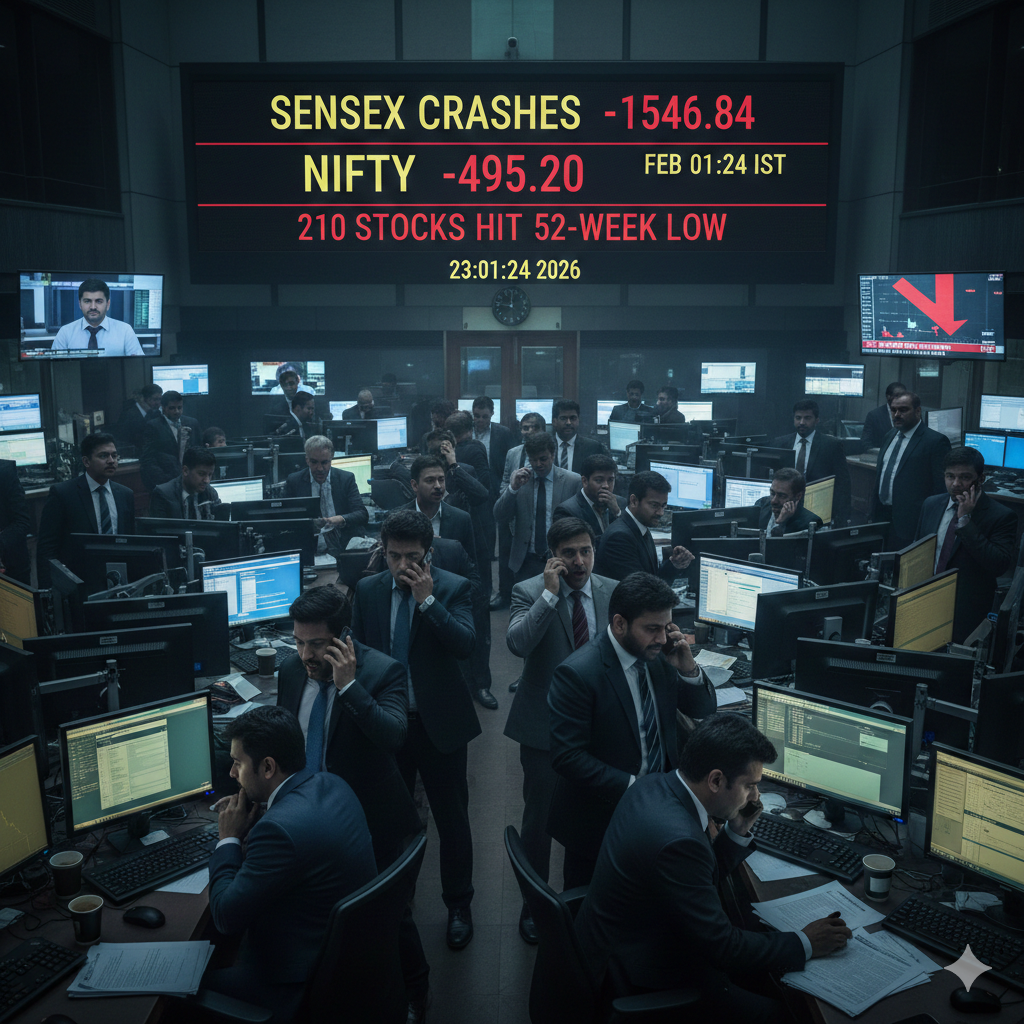

MUMBAI – The Indian stock market witnessed a dramatic sell-off during a rare Sunday trading session on February 1, 2026, as the Union Budget 2026-27 failed to satisfy investor appetite. While the government maintained its focus on infrastructure with a ₹12.2 lakh crore capex outlay, the “sting in the tail” came from a significant hike in the Securities Transaction Tax (STT) on derivatives.

The benchmark BSE Sensex plummeted 1,546.84 points (1.88%) to close at 80,722.94, while the NSE Nifty 50 sank 495.20 points (1.96%) to finish at 24,825.45. At its intraday worst, the Sensex had crashed by over 2,300 points, briefly slipping below the psychologically crucial 80,000 mark.

Sea of Red: 210 Stocks Touch Yearly Lows

The carnage was widespread across the National Stock Exchange (NSE), where 210 securities hit their 52-week lows. Large-cap and mid-cap favorites were not spared from the onslaught:

ITC: Hit a low of ₹310, down nearly 4% as the Budget introduced an additional excise duty on cigarettes and tobacco products.

IREDA & IRCTC: Both PSU stalwarts hit fresh 52-week lows of ₹124.11 and ₹600 respectively, as the broader sell-off in public sector undertakings intensified.

Patanjali Foods: Touched a yearly low of ₹484.00, reflecting a broader weakness in the FMCG space.

Others in the Pit: Prominent names like SBI Cards, Godrej Properties, Indian Hotels, and ACC Limited also breached their 52-week support levels during the session.

Why the Markets Crashed

Analysts point to a “triple whammy” of factors that spooked the D-Street:

The STT Shock: Finance Minister Nirmala Sitharaman announced an increase in STT on futures trading (from 0.02% to 0.05%) and options (up to 0.15%). This move, aimed at curbing “excessive speculation,” directly impacts high-frequency traders and liquidity providers.

Taxation on Buybacks: The proposal to tax buyback proceeds as capital gains for shareholders added to the negative sentiment, closing a previously tax-efficient route for returning cash to investors.

Conservative Capex: While the 9% increase in capital expenditure was stable, it fell short of the double-digit growth (11–15%) that many institutional investors had “priced in” prior to the announcement.

“The increase in STT was a clear shock for the market. It significantly raises transaction costs at a time when retail participation was already under watch by regulators,” said an analyst at a leading Mumbai-based brokerage.

Sectoral Highlights

While the PSU Bank index dropped over 5% and Realty fell nearly 6%, the IT sector managed to find some footing, ending marginally in the green (0.57%) thanks to a higher safe-harbor threshold for foreign companies. Data center-linked stocks like Netweb Technologies and Anant Raj also bucked the trend, gaining up to 13% on new tax incentives.

As the dust settles on the 2026 Budget, the focus now shifts to whether the market can find a floor or if the higher cost of trading will lead to a sustained dip in volumes.